Meaning of an invoice

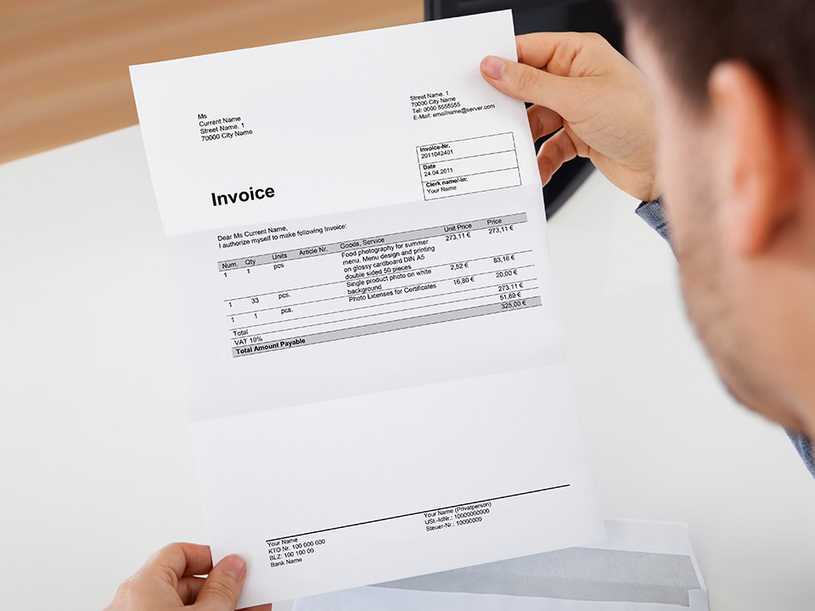

An invoice is a document that records and retains a transaction between the seller and buyer. If goods or services were obtained on account, the invoice basically defines the terms of the agreement and gives information on the available methods of payment. Invoices are crucial constituents of accounting internal controls and also audits. The responsible management personnel approves charges found on an invoice.

This document mainly outlines – 1) payment terms; 2) unit costs; 3) handling; and any other terms drafted during the transaction.

Types of invoices may involve – 1) a paper receipt; 2) a bill of sale; 3) debit note; 4) sales invoice; 5) online electronic record.

So, to summarize, an invoice is a payment demand released by a seller to the buyer of goods or services following the sale, detailing what kind of work was done or what goods have been supplied, and how much must be paid in exchange.

Find out other useful, free, downloadable templates here.

What is an invoice utilized for?

Invoices can be utilized to bill for recurring work or for a single project, but they are most frequently utilized to request payment following fulfilled work, and when there is a continuing relationship with the customer. Customarily, invoices came in paper form, either typed or handwritten and then the document was sent by post. In order to speed up delivery, in recent years, many businesses have exercised email. Though, the most technically competent companies, nowadays employ specialist software to immediately generate e-invoices, that help to flow information automatically between the seller and buyer.

What should you include in an invoice?

Firstly, you must make sure that on the face of the bill it must be defined that it is an invoice. For internal and external reference, typically it has a unique identifier that is called the invoice number, the mentioned identifier is very useful. An invoice usually involves a piece of information about the contact details of the seller or service provider, this information is needed, in case there is a mistake concerning the billing.

On the invoice, payment terms may be specified, as well as the information concerning any discounts, information about early payment, or finance charges considered for late payments. It also presents: 1) the unit cost of an item; 2) total units purchased; 3) freight; 4) handling; 5) shipping; 6) associated tax charges; 7) total amount owed.

Companies may choose to send just a month-end statement of account as per the invoice for all unpaid transactions. The statement must denote that no further invoices will be sent if this is the case. Invoices have been recorded on paper historically, frequently with several copies made so that the seller and buyer, each have a record of the transaction for their personal records. Nowadays, computer-generated invoices are quite typical. They can be sent by email to the parties of a transaction or printed to paper if required. When records are made electronically, it facilitates the searching and sorting of specific transactions or concrete dates.

If you are interested in what a Purchase Order is and want to download a free template, click here.

A preliminary bill of sale sent to buyers ahead of a shipment or delivery of goods is known as a pro forma invoice. The invoice will commonly describe the obtained items and other crucial information such as the transport charges and shipping weight. Pro forma invoices are frequently utilized with international transactions, mainly for customs purposes on imports.

What should be included in an invoice?

1) The word “Invoice” marked clearly at the top of the document; 2) A unique number or reference; 3) The name, address, and contact details of the individual or company issuing the invoice; 4) The name and invoice address of the person or organization being invoiced; 5) A description of what product or service the invoice covers; 6) The goods or service provision date; 7) The invoice issue date; 8) The amount of money owed, detailing the VAT sum (if necessary) or any arranged in advance discounts, and also the entire total due; 9) The invoice due date (deadline for payment to be made).

What is an address of an invoice?

The address of an invoice is the legal address of the purchaser or address where they get correspondence. It differs from the shipping address/delivery address, where goods or services are to be delivered. in some cases, these addresses may be the same and in some cases, they may be different.

Check out the free, downloadable Liability waiver form (Release of liability)

What is a due date of an invoice?

The due date of an invoice is the date on which the entire payment of the invoice total is due. The invoice is considered overdue if this date passes and the total amount hasn’t been paid.

Invoice date importance

The time and date on which the goods have been billed and the transaction officially recorded is represented by the invoice date. Hence, the invoice date has crucial details concerning payment, as it dictates the due date of the bill and credit period. This is particularly important for entities offering credit. The genuine due date of the invoice is usually thirty days after the invoice date. In the same way, companies offer customers the alternative to return items generally having a deadline based on a specific number of days since proof of purchase, as stated on the invoice.

How do invoices work?

Firstly, your customer agrees to obtain goods or services from you. The parties involved, i.e., you and your customer’s businesses, and the details of the sale are determined on an invoice (a document that is an official request for payment). You can make the invoice, via specialist software or manually and issue it to your customer. When you receive the invoice, your customer has a period of time in which they have lawfully agreed to pay you by 30 days commonly, though, many variants exist. After a customer makes the full payment, you reconcile the invoice, to complete the transaction.

Check out the free form of a Girlfriend Application here

Below you can download invoice templates (in excel format) for free: